Thailand is the “Detroit of Asia.” Its automotive sector is a powerhouse of productivity. But with this success comes intense competition. As the Southeast Asia lubricants market is set to reach USD 7.68 billion by 2033, the pressure on auto parts suppliers is immense . They face constant demands for lower prices, higher quality, and faster delivery.

In this environment, traditional cost-cutting is not enough. Focusing only on the purchase price of consumables, like lubricants, is a failing strategy. The real path to profitability lies in managing the Total Cost of Ownership (TCO).

This case study explores how “Siam Auto Parts,” a typical Thai automotive supplier, transformed its operations. By switching to high-performance synthetic lubricants Thailand from Zhongtian Petrochemical, they cut their TCO by an incredible 30% and boosted overall efficiency.

The Challenge: Navigating Thailand’s Competitive Automotive Manufacturing Landscape

A Thriving Market with Razor-Thin Margins

Thailand is a major production hub for global car brands (OEMs). Siam Auto Parts is a key player in this supply chain, producing high-precision metal components. Their operations manager, Somchai, faced a difficult problem.

His hydraulic presses and CNC machines had to run constantly to meet demand. But maintenance costs, energy bills, and unexpected downtime were eating away at their profits. The pressure was on to find a solution.

Southeast Asia Lubricants Market Growth

The Hidden Costs of Conventional Lubricants

Initially, Siam Auto Parts used cheap, conventional mineral oils. This seemed like a smart way to save money. However, this short-term thinking created long-term problems. The company’s maintenance logs revealed a pattern of hidden costs:

- Frequent Maintenance: The mineral-based oils broke down quickly under heat and pressure. This forced the team to change the oil in critical machines every three months, causing hours of lost production each time.

- High Energy Bills: Poor lubrication creates more friction. This means motors must work harder, consuming more electricity. The factory’s energy costs were unnecessarily high.

- Costly Breakdowns: Sludge and varnish from the old oil caused hydraulic valves to fail. Increased wear on gears led to two catastrophic equipment failures in one year. The cost was over $500,000 in repairs and lost orders.

Somchai knew they needed a new strategy. The focus had to shift from low purchase price to high operational efficiency.

Breakdown of Hidden Costs with Conventional Lubricants

The Solution: A Strategic Shift to High-Performance Synthetic Lubricants

After careful research, Siam Auto Parts partnered with Zhongtian Petrochemical. With an annual production capacity of 200,000 tons and over 100 patents, Zhongtian had the stability and technical expertise they needed.

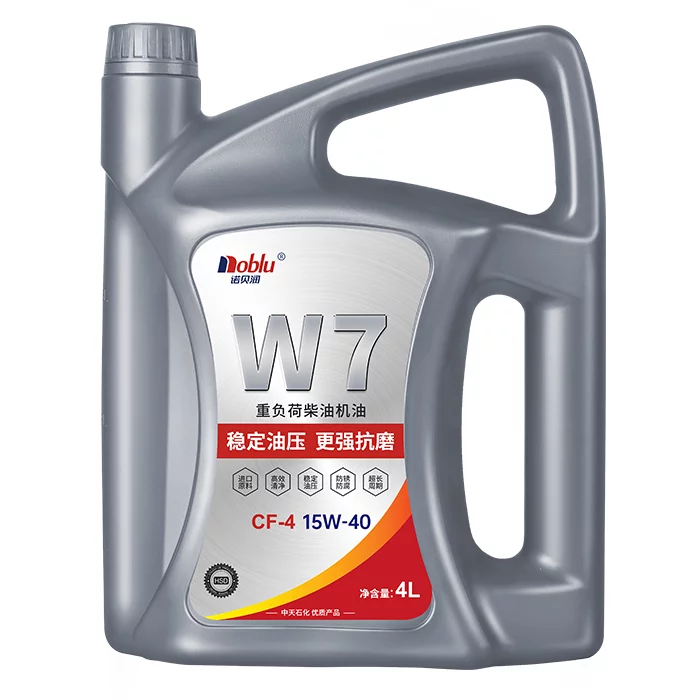

Why Zhongtian Petrochemical’s Synthetic Lubricants?

Zhongtian’s technical team recommended two key products: the synthetic versions of their High-Pressure Anti-Wear Hydraulic Oil (L-HM Series) and Heavy-Duty Industrial Gear Oil (L-CKD Series). These synthetic lubricants Thailand offered clear advantages over mineral oils:

- Superior Stability: Synthetic base oils resist thermal breakdown. This extends the oil change interval from 3 months to over 12 months, drastically reducing downtime.

- Enhanced Protection: Advanced additives create a strong protective film on metal surfaces. This prevents wear on gears and hydraulic pumps, extending equipment life.

- Lower Friction: Synthetics flow more easily, reducing internal friction. This leads to lower energy consumption and real cost savings.

Learn more about our Industrial Hydraulic Oil solutions

The Implementation Process

This was more than just an oil change. Zhongtian provided a complete service package:

- Baseline Analysis: They took oil samples from key machines to establish a baseline for wear, contamination, and energy use.

- System Flush: The team guided Siam’s maintenance crew through a thorough system cleaning to remove old deposits.

- Performance Monitoring: After the switch, regular oil analysis tracked the health of the new lubricant and the condition of the machinery, allowing for data-driven maintenance decisions.

The Results: A Quantifiable 30% Reduction in Total Cost of Ownership (TCO)

The one-year pilot program was a huge success. Siam Auto Parts achieved significant savings and efficiency gains. The switch to Zhongtian’s synthetic lubricants allowed them to effectively reduce TCO.

Deconstructing the TCO Savings

The following table breaks down the annual savings for a single large hydraulic press.

| Cost Factor | Conventional Mineral Oil (Annual Cost) | Zhongtian Synthetic Lubricant (Annual Cost) | Annual Savings |

| Lubricant Purchase | $8,000 | $6,000 | -$2,000 |

| Maintenance Labor | $4,800 | $1,200 | $3,600 |

| Production Downtime Loss | $80,000 | $20,000 | $60,000 |

| Energy Consumption | $50,000 | $46,500 (7% Savings) | $3,500 |

| Spare Parts | $15,000 | $3,000 | $12,000 |

| Annual TCO | $157,800 | $76,700 | $81,100 (51.4% Savings) |

Export to Sheets

Note: This table is an illustrative model. Across the entire factory, Siam Auto Parts achieved an overall TCO reduction of approximately 30%.

TCO Savings with Synthetic Lubricants

Beyond the Numbers: The Ripple Effect

The financial savings were just the beginning. The company saw other major benefits:

- Predictable Production: Planned downtime was cut by 75%, making production schedules more reliable.

- Higher Quality: A stable hydraulic system led to more precise manufacturing, increasing the product acceptance rate by 2%.

- Greener Operations: With 75% less waste oil and lower energy use, the company improved its sustainability profile, a key factor for its European customers.

An infographic highlighting the key benefits beyond cost savings: an icon of a calendar for ‘Predictable Production,

The Broader Context: Why This Matters for the Thai Automotive Sector

Siam Auto Parts’ story is not unique. It reflects a major shift in Southeast Asia’s automotive manufacturing industry. The market is moving away from cheap mineral oils and toward high-performance synthetics. This change is driven by OEM demands for better fuel efficiency and longer-lasting components.

For Thai suppliers, adopting premium synthetic lubricants Thailand is a strategic necessity. It’s not just about cutting costs. It’s about meeting customer expectations and staying competitive in a global supply chain. As the respected market research firm IMARC Group notes, technological innovation is the key driver of market growth .

!(https://storage.googleapis.com/www.ztshoil.com/thai_factory.png “Advanced Automotive Manufacturing in Thailand”) Alt Text: An advanced automotive production line in Thailand, a key application market for high-performance synthetic lubricants Thailand.

Your Path to a Lower TCO

The lesson from Siam Auto Parts is clear: the cheapest option is often the most expensive in the long run.

By shifting focus from purchase price to Total Cost of Ownership, companies can unlock massive savings and efficiency gains. Partnering with a technical expert like Zhongtian Petrochemical provides the products and support needed to succeed.

For automotive suppliers in Thailand and across Southeast Asia, it’s time to rethink your lubrication strategy. Choosing the right synthetic lubricants Thailand solution protects your equipment, your profits, and your competitive edge.

Ready to start your TCO reduction journey? Contact us today.